Send Email :

info@telic.digital

Send Email :

info@telic.digital

Call us :

0303 666 5438

Call us :

0303 666 5438

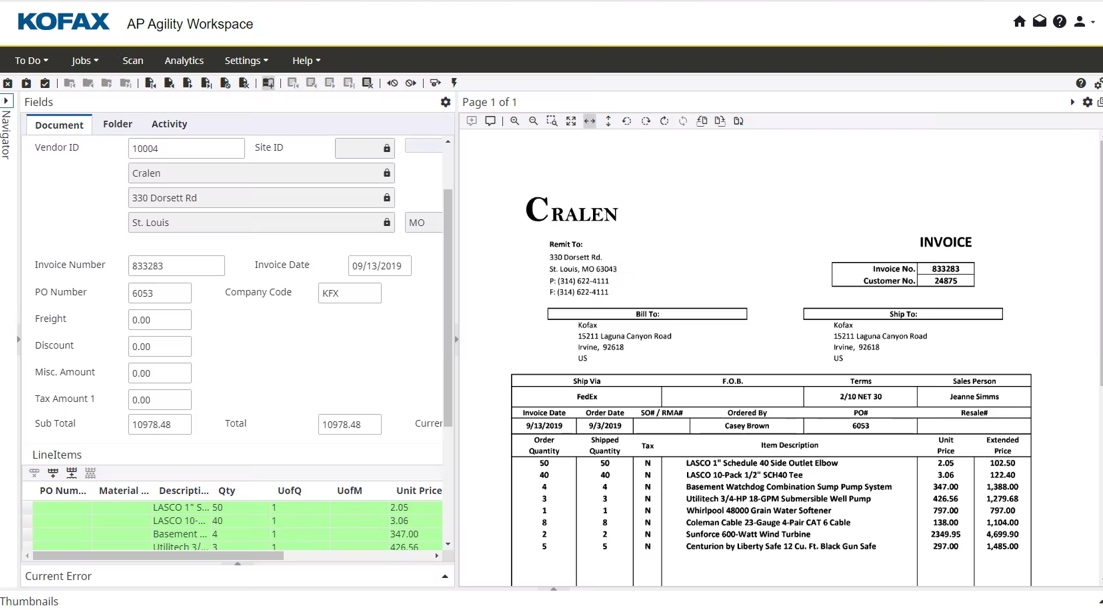

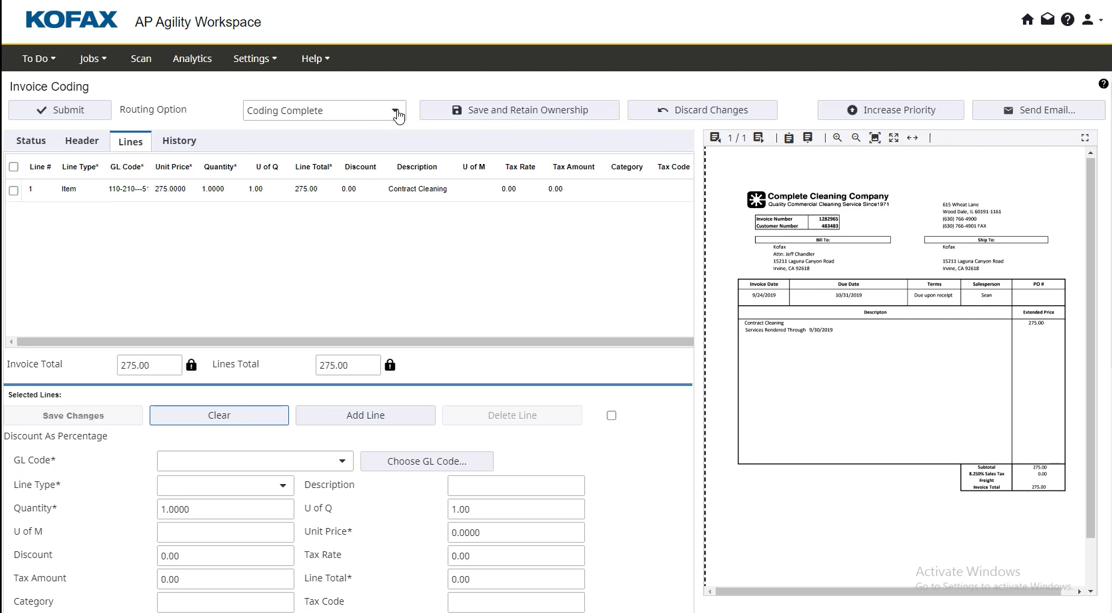

Accounts Payable Automation allows invoice data to be automatically extracted, validated and matched to purchase order data and for invoices to be routed to users for coding, approval, and exception handling activities. A manual accounts payable process involves individuals in the team spending significant time manually keying data, routing invoices to others in the organisation and chasing for approvals.

Our platform uses leading technologies, AI (Artificial Intelligence), Machine Learning and RPA (robotic process automation), to automate the manual steps, ensure continual self-learning for increased accuracy and predictive analytics for better identification and handling of potential exceptions.

To discover how you can automate your accounts payable processes, book a demo to see the platform at work

Reduce invoice processing time and costs by upto 80%

Use process automation technologies to optimise invoice approvals and coding processes

Utilise process insights to allow your organisation to react quickly and make informed decisions

Automate accounts payable processes to increase accuracy, reduce time and costs associated with manual processes and provide the organisation with visibility of transactions. The platform will automatically ingest any format of invoice, validate and match the data and drive digital workflows for coding and approval. This greatly reduces manual activities for time spent manually keying, searching for invoices and chasing for approvals to pay.

Accounts payable teams are often under significant pressure to process invoices. With manual processes, errors can be made, payments duplicated, fraud remains undetected and supplier relations can be damaged as a result of late payment. Managing paper and controlling processes manually leads to poor visibility of critical financial processes and can mean significant time and effort is spent chasing invoice approvals and coding.

Our AP automation platform will ingest invoices from any source including email, scans and portals. It will recognise data from invoices and perform automated validation and extraction, before matching to purchase order and GRN data. Digital workflows then route electronic copies of invoices to individuals across the organisation who need to code and approve transactions. Finally data is transferred into any ERP or Finance system including Microsoft Dynamics 365 Business Central, Microsoft Dynamics 365 Finance, Oracle NetSuite, Oracle Fusion Cloud, and Coupa.

Kofax AP Essentials seamlessly integrates with your current financial systems, streamlining the end-to-end process and minimising the need for manual data entry. This boosts efficiency and saves valuable time.

Analytics and dashboards provide full insight on invoice status and activities. This visibility gives accounts payable teams full visibility of all invoice transactions and the necessary tools to be able to action queries and identify exceptions.